medium-term downtrend

#1

Always act in the direction of the respective parent trend

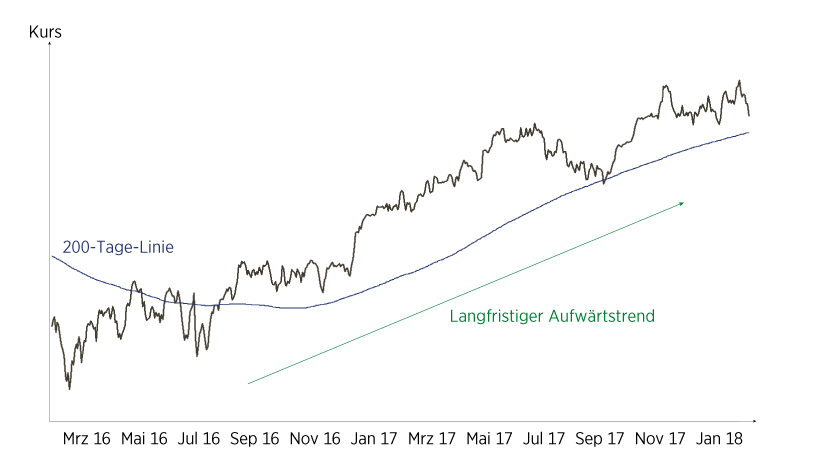

This principle springs from the premises of technical analysis that trends exist on the one hand and on the other hand set the path of least resistance. Acting in the direction of the trend is therefore fundamentally more promising than stifling the trend. The implementation of the principle into practice is a two-step process: First of all, the underlying value of the trend in the respective time levels must be long-term, medium-term and short-term. Subsequently, one looks for technical purchase signals or sales signals, which are each one level below the trend in question. If you are more of a medium-term (position) trader, you are looking for a long-term uptrend preferred to buy signals of an anticyclical or pro-cyclical nature in the medium-term chart image. If, on the other hand, you tend to be short-term (swing) traders who only want to be involved for hours to several days, you would be looking for buy signals in the short-term chart picture in the mid-term uptrend.

Work from the long-term chart picture to the short-term chart picture

Closely linked to the former rule is the further rule to start with the long-term chart in order to identify the long-term trend and relevant long-term resistance and support when analyzing the technical starting position of an underlying asset. Subsequently, one would take the medium-term picture under the magnifying glass and then the short-term chart situation. In practice, the weekly chart is used for the long-term analysis, the daily chart for the medium-term analysis, and the hourly chart for the short-term analysis. Very short-term investors who are on the move in the minute or hour range, often also use 15-minute charts, 5-minute charts or even 1-minute charts. The fact that one works from the longer time levels into the shorter time levels, and not the other way round, is due to the fact that the "noise" of the market becomes greater the shorter the period under consideration becomes. In other words, the reliability of signals decreases successively when working from the long-term chart into the short-term chart. The shorter the period under consideration, the more frequently one encounters erroneous outbreaks. The outbreaks usually arise contrary to the direction of the higher level of time. This means, for example, that the likelihood that an outbreak from a short-term trade margin to the south turns out to be a retrograde outbreak is higher in the medium-term uptrend than in the medium-term downtrend.

Beste Grüsse aus Frankfurt am Main

Emin Schmidt